BTC Price Prediction: How High Will BTC Go Amid Bullish Technicals and Institutional Demand?

#BTC

- Technical Strength: BTC trades above key moving averages with bullish MACD crossover.

- Institutional Catalysts: Regulatory recognition and ETF inflows drive demand.

- Macro Tailwinds: Fed policy and liquidity injections support risk assets.

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge as Price Breaks Key Levels

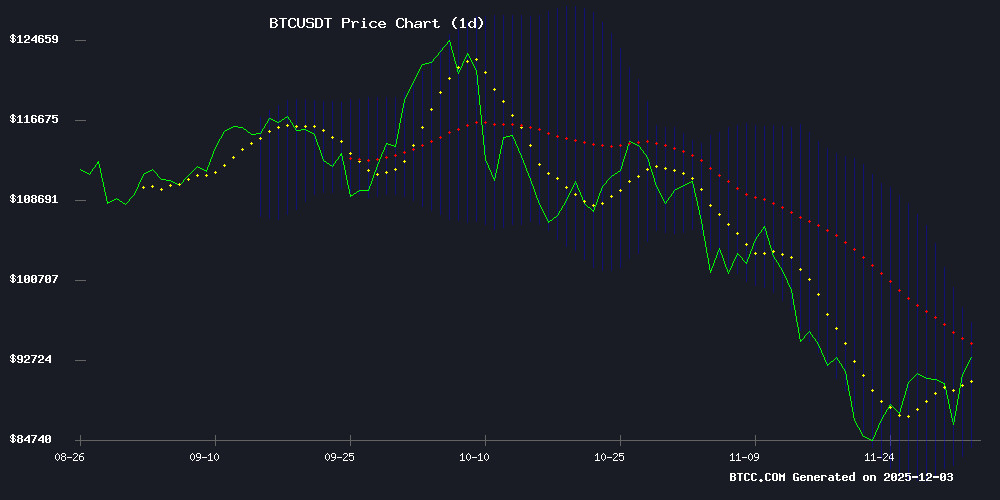

BTC is currently trading at 93,003.79 USDT, comfortably above the 20-day moving average of 90,231.3885, indicating a strong bullish trend. The MACD shows a bullish crossover with the histogram at -2,274.5189, suggesting potential upward momentum. Bollinger Bands reveal the price is NEAR the upper band at 96,495.4136, signaling overbought conditions but also strong buying pressure. According to BTCC financial analyst Robert, 'The technical setup supports further upside, with a potential test of the $100,000 psychological level if the current momentum sustains.'

Market Sentiment Turns Bullish as Institutional Adoption Grows

Recent headlines highlight significant developments boosting BTC's appeal: the UK recognizing crypto as property, MicroStrategy maintaining its index inclusion, and Bank of America approving Bitcoin allocations for high-net-worth clients. BTCC financial analyst Robert notes, 'These institutional endorsements, combined with surging ETF flows and favorable monetary conditions, create a perfect storm for BTC's price appreciation. The Fed's liquidity injections and rising trading volumes further fuel bullish sentiment.'

Factors Influencing BTC’s Price

UK Recognizes Crypto as Property in Landmark Legislation

The UK has cemented its position as a crypto-friendly jurisdiction with the formal enactment of the Property (Digital Assets etc) Bill. This legislation classifies cryptocurrencies and stablecoins as personal property, providing a robust legal framework for ownership disputes and insolvency proceedings.

Legal clarity around digital asset classification removes a significant barrier to institutional adoption. The move follows years of common law precedents and implements recommendations from the 2024 Law Commission report, signaling regulatory maturity in one of the world's leading financial centers.

Industry advocates like Bitcoin Policy UK's Freddie New hailed the development as transformative. "This establishes England as the preeminent common law jurisdiction for digital assets," New remarked on social media platform X. The legislation arrives alongside promised consumer protection measures aimed at fostering responsible industry growth.

Michael Saylor Engages MSCI to Maintain MicroStrategy's Index Inclusion Amid Crypto Scrutiny

MicroStrategy Inc. is actively lobbying MSCI Inc. to retain its position in the global indexes as the index provider reviews companies with significant digital-asset exposure. Executive Chairman Michael Saylor confirmed ongoing discussions during MSCI's consultation period, which runs through 2025, challenging bearish outflow projections from analysts.

The business intelligence firm holds 650,000 BTC—worth approximately $1.44 billion at current reserves—while adjusting its 2025 price targets below $90,000. MSCI's review focuses on whether corporate crypto holdings align with its index methodology, potentially affecting other companies with crypto-heavy balance sheets.

Saylor dismissed JPMorgan Chase & Co.'s estimates of passive fund outflows should MSCI remove MicroStrategy's Class A shares (MSTR) from its benchmarks. The outcome could set a precedent for how traditional finance indexes accommodate companies embracing Bitcoin as a treasury asset.

Bank of America Approves 1-4% Bitcoin Allocation for High-Net-Worth Clients

Bank of America has authorized its financial advisors to allocate 1-4% of high-net-worth client portfolios to Bitcoin through regulated ETFs. The move signals growing institutional confidence in cryptocurrency as a legitimate asset class.

The approved products include Bitwise Bitcoin ETF (BITB), Fidelity Wise Origin Bitcoin Trust (FBTC), and other regulated vehicles offering custody, monitoring, and transparent fee structures. This structured approach reflects BOA's emphasis on risk management while acknowledging Bitcoin's maturing market position.

Bitwise CEO Hunter Horsley characterized the decision as a watershed moment for mainstream crypto adoption. BOA's Chief Investment Officer Chris Hyzy emphasized the importance of using regulated products to maintain prudent risk allocation, noting that Bitcoin's unique characteristics require careful study.

Bitcoin Price Prediction: Trading Volumes Near 2025 Peak as BTC Hits $80K – Are Buyers Coming Back?

Bitcoin (BTC) surged nearly 6% over the past week, holding above $90,000 as selling pressure eased. The market opened with volatility following the Bank of Japan's signal of a potential December rate hike, but Vanguard's move to allow digital asset ETF trading on its platform provided a counterbalance.

Trading volumes hit their second-highest weekly level this year as BTC briefly dipped to $80,000, according to Artemis data. This price point appears to be a critical battleground between buyers and sellers, setting up a pivotal moment for Bitcoin's near-term trajectory.

The rebound from $80,000 triggered significant short liquidations—$325 million on Monday followed by $400 million in the past 24 hours as BTC climbed 4.4%. A sustained recovery could fuel a short squeeze, though downside risk remains with $78,000 untested as support.

Crypto Casino Payout Speed: The Hidden Mechanics of Bitcoin Settlement

Crypto casinos often advertise payout speeds in minutes or hours, but the underlying mechanics reveal a more complex reality. Transaction confirmation policies, liquidity staging, and internal queue management collectively determine whether withdrawals feel instantaneous or sluggish. The critical question for users—whether delays stem from blockchain limitations or platform infrastructure—typically involves both factors, with platform architecture playing the dominant role.

Bitcoin transactions require multiple confirmations for finality, with industry standards ranging from 3 to 6 depending on risk appetite and network conditions. Yet confirmation times alone don’t dictate speed. Liquidity architecture is the decisive variable: funds may reside in ready-to-release hot wallets, undergo conversion in warm buffers, or await batch processing in cold storage. Optimized platforms dynamically rebalance these layers, while inefficient systems introduce friction.

Bitcoin Surges 11% as Fed Resumes Liquidity Injections

Bitcoin rallied sharply overnight, climbing 11% from $83,822 to surpass $93,000 after the Federal Reserve quietly restarted large-scale liquidity operations. The New York Fed injected $38 billion through repo operations—the largest such intervention since 2020—while simultaneously ending quantitative tightening.

The dual policy shift flooded markets with dollar liquidity, easing funding stresses and creating ideal conditions for high-beta assets. Weak manufacturing data further fueled the rally, with the ISM PMI's ninth consecutive contraction pushing Fed rate cut probabilities above 80% for December.

Traders interpreted Vanguard's move to open its $9 trillion platform to third-party crypto products as a watershed institutional adoption signal. The surge reversed December 1 losses attributed to Bank of Japan policy speculation and thin crypto market liquidity.

Europol Leads Takedown of Cryptomixer After Tracing €1.3B in Laundered Bitcoin

European authorities dismantled Cryptomixer, a crypto anonymizing service, in a coordinated Swiss-German operation. The platform processed over €1.3B in Bitcoin since 2016, primarily for laundering illicit funds. Servers, domains, and €25M in Bitcoin were seized during raids in Zurich.

Europol’s Joint Cybercrime Action Taskforce (J-CAT) and Eurojust facilitated cross-border intelligence sharing and forensic analysis. The takedown reflects escalating regulatory scrutiny of crypto mixers, which cybercriminals increasingly exploit to obscure transaction trails.

Bitcoin ETF Flows Surge as Vanguard Sees $1B in Early Trading

Bitcoin ETF net flows have turned positive, signaling renewed investor interest after weeks of cooling demand. Vanguard's Bitcoin ETF posted nearly $1 billion in first-day trading volume, underscoring strong institutional participation.

Strengthening inflows into Bitcoin ETFs may support the next upside phase for BTC, acting as a key indicator of improving market sentiment. Recent data shows a shift from negative or neutral flows to a growing positive trend among U.S. spot BTC ETF issuers.

While some issuers still report minor outflows, the aggregate inflow trend reflects increased appetite for BTC exposure through ETFs—particularly during a period of low overall volatility in the Bitcoin market. Analysts interpret this as the early stages of a healthy recovery for ETF investors.

At press time, BTC traded up 6.79% over the past 24 hours.

Gold Outshines Bitcoin Despite Favorable Monetary Conditions

Gold has surged past $4,250 per ounce, while silver notches all-time highs with a 100% year-to-date gain, overshadowing Bitcoin's lackluster performance. Investors are flocking to traditional safe-haven assets even as the Federal Reserve pivots to liquidity injections—a scenario that historically favors risk assets like cryptocurrencies.

Bitcoin trades around $92,690, 26% below its October 2025 peak of $126,270, following a volatile week that saw it plunge to $84,000 before rebounding. The divergence from precious metals persists despite monetary conditions that typically fuel crypto rallies—quantitative tightening ended December 1 after $2.4 trillion in withdrawals since 2022, with the Fed now deploying $13.5 billion in repo operations.

This liquidity surge mirrors environments that previously propelled Bitcoin and gold simultaneously. Yet the cryptocurrency struggles as bullion advances—a paradox underscoring shifting investor priorities amid macroeconomic uncertainty.

Bitcoin's Valuation Gap: A Macroeconomic Paradox

Gold surges to record highs as global liquidity reaches unprecedented levels, yet Bitcoin remains stagnant below $100,000—a divergence that defies its reputation as a hedge against monetary dilution. Bitwise's latest report highlights a 66% undervaluation gap between BTC and global money supply growth, suggesting a theoretical fair value of $270,000. The disconnect raises pressing questions: Is this a market inefficiency or a latent opportunity?

Analysts point to 2026 as a potential inflection point, where Bitcoin's price may realign with macroeconomic fundamentals. The cointegration model cited by Bitwise tracks BTC against the $137 trillion global M2 monetary aggregate, revealing one of the largest valuation disparities in the asset's history.

Analysts Reaffirm $1 Million Bitcoin Target Amid Altcoin Surge

Bitcoin's rebound to $93,299—a 7% surge in 24 hours—has reignited bullish forecasts, with Cathie Wood and other prominent figures reiterating $1 million price targets within five years. The cryptocurrency now commands a $1.86 trillion market cap, though volatility persists, with BTC oscillating between $84,100 and $92,300 this week.

Institutional activity underscores the momentum. BlackRock moved 2,156 BTC ($186 million) on December 1, signaling sustained heavyweight interest. Yet traders increasingly pivot to altcoins like Remittix, a payments-focused DeFi project, seeking outsized gains beyond Bitcoin's megacap dominance.

How High Will BTC Price Go?

Based on current technicals and market sentiment, BTC could target $100,000 in the near term. Key factors include:

| Factor | Impact |

|---|---|

| Technical Breakout | Price above 20-day MA and upper Bollinger Band |

| Institutional Demand | Bank of America allocations and ETF inflows |

| Macro Environment | Fed liquidity injections and regulatory clarity |

Robert emphasizes, 'The $80K resistance break and high trading volumes mirror 2025's peak activity, suggesting renewed buyer interest.'